Alleged Scheme Involves Concealment of $47 Million in Distributions

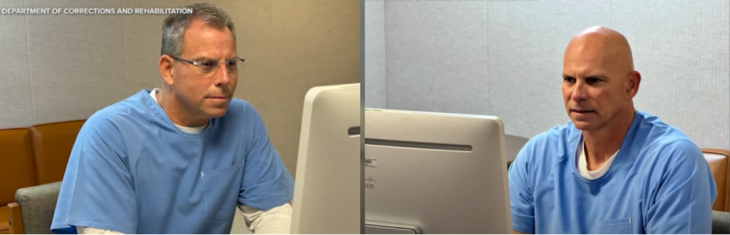

Andrew A. Wiederhorn, the former CEO and current controlling shareholder of Fat Brands Inc. (FAT), has been indicted on federal charges alleging a scheme to conceal $47 million in distributions he received in the form of shareholder loans from the IRS, FAT’s minority shareholders, and the broader investing public, the Justice Department announced Thursday.

The indictment, returned by a federal grand jury, accuses Wiederhorn of concealing millions of dollars in reportable compensation and taxable income, evading the payment of millions of dollars in taxes, and causing FAT to violate the Sarbanes-Oxley Act’s prohibition on direct and indirect extensions of credit to public-company CEOs in the form of a personal loan.

United States Attorney Martin Estrada stated, “This defendant, the former CEO of a publicly traded company, is alleged to have engaged in a long-running scheme to defraud investors and the United States Treasury to the tune of millions of dollars. Instead of looking out for shareholders, the defendant allegedly treated the company as his personal slush fund, in violation of federal law.”

According to the indictment, Wiederhorn, assisted by FAT’s chief financial officer and his outside accountant at advisory firm Andersen, concealed distributions to himself as shareholder loans approximately 30 years ago, when he served as CEO of another company, Wilshire Credit Corporation (WCC). The indictment also alleges that from at least 2006 through 2021, Wiederhorn caused employees of FAT and its former affiliate, Fog Cutter Capital Corporation (FOG), to compensate him by distributing approximately $47 million for his personal use and benefit, miscategorized as “shareholder loans.”

“These disbursements were used to fund the purchase of private-jet travel, vacations, a Rolls Royce Phantom, other luxury automobiles, jewelry, and a piano,” the indictment states.

Wiederhorn, along with other defendants named in the indictment, is expected to be arraigned in the United States District Court in downtown Los Angeles. The indictment charges Wiederhorn with one count of endeavoring to obstruct the administration of the Internal Revenue Code, six counts of tax evasion, and one count of false statements and omission of material facts in statements to accountants in connection with audits and reviews.

Additionally, Wiederhorn, Hershinger, and FAT are charged with two counts of extension and maintenance of credit in the form of personal loans from the issuer to the executive officer.

An indictment is merely an allegation, and the defendant is presumed innocent unless and until proven guilty beyond a reasonable doubt in a court of law.

The FBI and IRS Criminal Investigation are investigating this matter, and investors who believe they were victims of the alleged crimes are encouraged to visit [insert link] for further information and updates.

Separately, the U.S. Securities and Exchange Commission has filed a civil enforcement action against Wiederhorn, Hershinger, FAT, and another FAT executive.

The case is being prosecuted by Assistant United States Attorneys Adam P. Schleifer of the Corporate and Securities Fraud Strike Force and Kevin B. Reidy of the Major Frauds Section.